Conveyancing update

Conveyancing practice and procedure update: new rules on stamp duty land tax

David Bowden summaries the main changes in stamp duty land tax (SDLT) by HM Treasury and HM Revenue and Customs (HMRC).1

About the author

David Bowden is a solicitor-advocate at David Bowden Law®

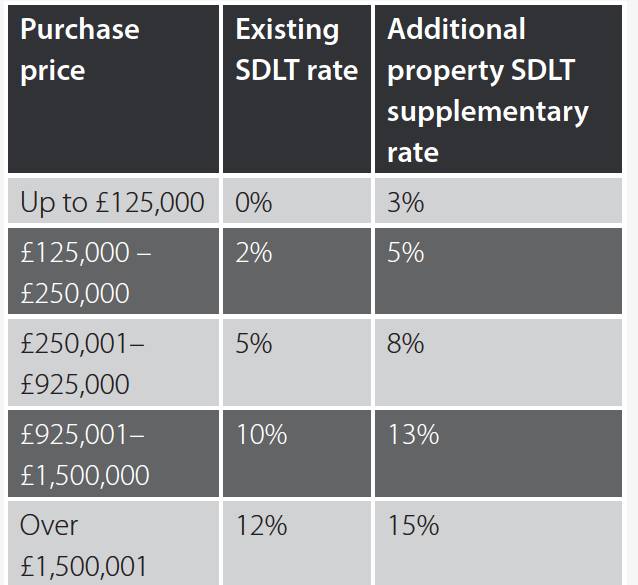

The measures that the chancellor George Osborne introduced so that buy-to-let investors pay an additional 3% SDLT on property purchases completed on or after 1 April 2016 have been widely reported. They led to many conveyancers being exceptionally busy in March to complete on transactions before the deadline. However, that is not the end of it. On 16 March 2016, both HM Treasury and HMRC issued documents which have further implications for SDLT. Conveyancers need to know their contents.

The Treasury issued a paper consulting on the SDLT changes on 28 December 2015.2 HM Treasury has now published a summary of those 909 consultation responses on SDLT. These are set out in its 36-page paper Higher rates of SDLT on purchases of additional residential property: summary of consultation responses.3 This explains the rationale for the changes to SDLT.

To accompany this HM Treasury publication, HMRC has published two guidance notes:

- Stamp Duty Land Tax: higher rates for purchases of additional residential properties (29 pages); and

- Stamp Duty Land Tax: reform of structure, rates and thresholds for non-residential land transactions (24 pages).4

The new SDLT rules have been very tightly drawn. The following transactions will not be covered by the new rules:

- houseboat purchases;

- caravan or mobile home purchases;

- leasehold properties with less than 21 years remaining; or

- homes costing less than £40,000.

If your client is not within these limited exemptions, anyone (not just buy-to-let investors) buying an additional property from 1 April 2016 will have to pay an additional SDLT.

For a house costing £300,000, a buyer will need to pay 5% SDLT. The total SDLT bill will come to £5,000. However, if that buyer already owns a home (for example, if they have recently inherited a home from a relative), there will be additional SDLT to pay of £14,000. The total SDLT bill will come to £19,000.

Where someone has inherited a property but is selling their existing family home to move to a new one, HM Treasury views this as a purchase of an additional property. This means that the additional SDLT must be paid.

However, if the inherited property is sold within 36 months of the purchase, buyers can apply to HMRC Birmingham Stamp Office for a refund of the additional SDLT. HMRC says that it will process refunds within 15 working days.

Any property owned by one partner, who is married or in a civil partnership and living together, will be included. HM Treasury is proposing to extend this to any joint buyers. Where a couple has separated, or live apart but have not yet divorced, the extra SDLT charge will not apply where one of them buys a new home.

HM Treasury says that the additional SDLT will apply where a buyer of a home in England, Wales or Northern Ireland already owns a property abroad.

Many parents buy property for their children to live in while at university. Unless the property is bought only in the child’s name(s), additional SDLT will be due.

Where someone is, for example, buying 10 flats in a block, if the SDLT payable is less when the multiple dwellings relief under Finance Act 2003 Schedule 6B is calculated, then that lower amount is due.

HM Treasury says that it wants to reduce SDLT for non-residential purchases of under £1.05m. HMRC says that six or more residential properties bought in a single transaction will be treated as a non-residential purchase.

HMRC says that SDLT of 2% will be due on that portion of the net present value of the rent over £5m. Where a tenant continues to occupy a non-residential property after their lease expired, SDLT will be calculated as if the original lease was extended by one year and using the SDLT rates in force at the time the lease was originally granted. Where a tenant continues to occupy after expiry of their lease and a new lease is granted within one year, SDLT will be calculated as if it were beginning immediately after the original lease and under the new SDLT rates for non-residential property. Where a lease is varied in the first five years to increase the rent, the variation is treated as the grant of a new lease for the additional rent.

The new SDLT rules apply to all completions after 1 April 2016. The Finance Bill, with explanatory notes and guidance, was published on 24 March 2016 and incorporates the SDLT changes in Parts 8 and 9 and in Schedule 16.5

1 A detailed follow up article will appear in (2016) June CILExJ.

2 Higher rates of stamp duty land tax (SDLT) on purchases of additional residential properties, available here. The consultation closed on 1 February 2016.

4 Available here and here respectively

5 Available here. The Finance Bill has been renamed the Finance (No 2) Bill, HC first reading, 22 March 2016