Conveyancing update

Conveyancing practice and procedure update: stamp duty land tax and business transactions - Part 1

David Bowden summaries the new rules from HM Revenue and Customs (HMRC) for business transactions in relation to stamp duty land tax (SDLT).1

About the author

David Bowden is a solicitor advocate at David Bowden Law®

In (2016) May CILExJ p20, the author looked at the new SDLT measures applying to buy-to-let investors, who have to pay an additional 3% SDLT on property purchases completed on or after 1 April 2016. There are also new rules applying to business transactions. These were set out on 16 March 2016 by HMRC in Stamp duty land tax: reform of structure, rates and thresholds for non-residential land transactions.2 This article will focus on this HMRC guidance as commercial conveyancers need to know its contents.

HMRC says that the government is reforming SDLT on non-residential properties ‘to make it fairer and cut the tax for businesses purchasing properties below £1.05m’ (page 20). HMRC says that for 76% of these transactions, businesses will pay less SDLT. These changes apply only to England, Wales and Northern Ireland. (Scotland has its own separate land and buildings transaction tax system).

HMRC says that this includes commercial property, shops, offices , agricultural land and land ‘not used as a residence’ (page 20). There are two other important transactions that fall within this umbrella definition:

- ‘mixed use’ properties such as the sale of a building comprising a shop with flat(s) above; and

- six or more residential properties bought in a single transaction.

The new business SDLT rules will apply to all completions after 17 March 2016. The Finance (No 2) Bill, introduced on 24 March 2016, incorporates these changes in Parts 8 and 9 and Schedule 16.

However, there are transitional arrangements which do not apply to buyers of residential property. HMRC says that where contracts have been exchanged before 17 March 2016 but complete after that date, the purchaser can choose whether to pay tax under the old or new rules. Interestingly, HMRC says that where parties decide to delay completion, this will not regard as tax avoidance.

As well as sales and purchases of business properties, the following business transactions are also covered by the SDLT changes:

- grant of a new lease;

- renewal of a lease;

- variation of lease;

- assignment of a lease; and

- holding over when a lease has expired.

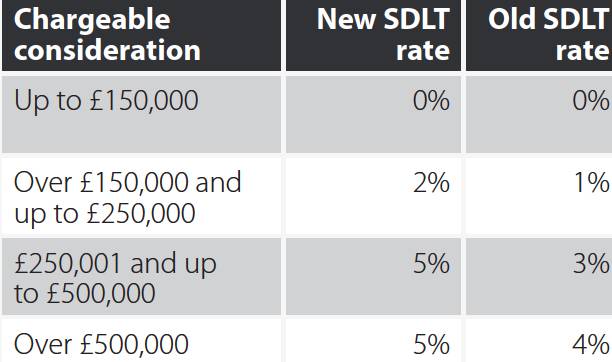

The new rates for purchases of freeholds, payments of premiums for a lease or an assignment of a lease are set out in the table below.

It should be noted that the nil rate for business transactions applies where the consideration is under £150,000, but for residential transactions the nil rate band only applies up to sales valued at £125,000 or less. While the 2% and 5% bands are broadly similar, the 5% tax rate is the top rate: there is no 10% or 12% rate that applies in residential purchases where the price is over £925,000 or £1.5m respectively. There is no additional property SDLT supplementary rate where a buyer already owns a property (unlike the position on residential properties).

The old rules applied a single rate to the entire transaction. This meant that for a purchase of a non-residential property costing £750,000, SDLT would be charged at 4% on the entire consideration.

However, the new rules apply the relevant rates to the slice of each part of the consideration. For example, for a non-residential property costing £350,000, before 17 March 2016 a buyer would need to pay £10,500 SDLT. However, under the new rules the SDLT bill is reduced to £7,000.

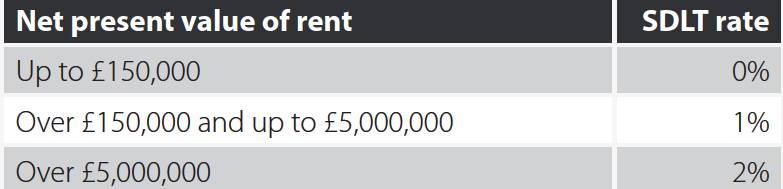

Rather confusingly, SDLT on rent will be charged at different rates on each slice of the rent. SDLT will be charged on the total rent due under a lease.

For example, where the net present value (NPV) of rent is £6m, the total SDLT will be £68,500 as the 2% rate only applies to the slice over £5m.

Before 17 March 2016, where the relevant rent on a lease was over £1,000, buyers could not benefit from the 0% threshold on premiums paid for a grant of a lease. This has now changed so that if the relevant rent is over £1,000, buyers can benefit from the 0% threshold for both the premium and rental elements.

To illustrate this, HMRC considers a lease for a shop bought for a premium £149,000, with a rent of £1,100 and a NPV of £4,065. Before 17 March 2016, SDLT would be charged at 1% on the lease premium producing a SDLT bill of £1,490; however, after 17 March no SDLT would be due on this lease premium because the rent is over the £1,000 threshold.

HMRC has put an online calculator tool on its website.3

1 The second part of this article will appear in (2016) July CILExJ

2 Available at: http://tinyurl.com/z34454n

3 Available at: http://tinyurl.com/h8poue7